Table of Content

If you rent an apartment, condo, house, etc., you need renters insurance. Get a renters insurance quote today and we'll show you how easy and affordable it is to protect what you care about. Our experienced agents can help you with any paperwork and to manage your policy.

This interactive calculator is a self-help tool and is not intended to provide financial advice or product recommendations. The results and explanations generated by this calculator are based upon, and will vary due to, your input and certain assumptions made by us. All projections are hypothetical in nature, do not reflect actual results, and are not guarantees of future results.

Bankrate

You might need more homeowners insurance coverage and not even realize it. Here are some commonly overlooked areas that could be putting you and your family at more financial risk than necessary. Liability coverage, or Coverage E, provides financial protection if you or your household's residents are liable for bodily injury and/or property damage.

Not only will this be useful for your very own protection, but your insurance prices will mirror the added stability as nicely. Following providing proof that your program is monitored by an agency, you may qualify for up to five% off your prices. If you have home insurance coverage and also have a puppy, make sure that you appear for plan choices that include people who might be attacked by your canine.

Can I make changes to my home that will lower my insurance cost?

For example, if you have a home deductible of $1,000 and a covered claim of $10,000, you're responsible for $1,000 and the insurer will pay the remaining $9,000. However, the amount of dwelling coverage you need may vary depending on the size of your home, the features in your home, and the cost of living in your area. At Insure.com, we are committed to providing honest and reliable information so that you can make the best financial decisions for you and your family. All of our content is written and reviewed by industry professionals and insurance experts. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research.

For example, if your TV is five years old, it is worth less than it was new. By insuring it at the replacement cost, your insurance company will pay its full replacement value rather than the depreciated amount. Of course, the best homeowners insurance company for you will depend on personal factors. That’s why it’s best to compare policies and quotes for your specific needs before you choose a company. At a dwelling coverage of $200,000, the average rate is $2,233, while a policy with $500,000 in dwelling coverage averages $3,594. Make confident that you use these residence-based mostly insurance policies tips when you want to check out out a coverage.

What isn't covered by a typical homeowners insurance policy?

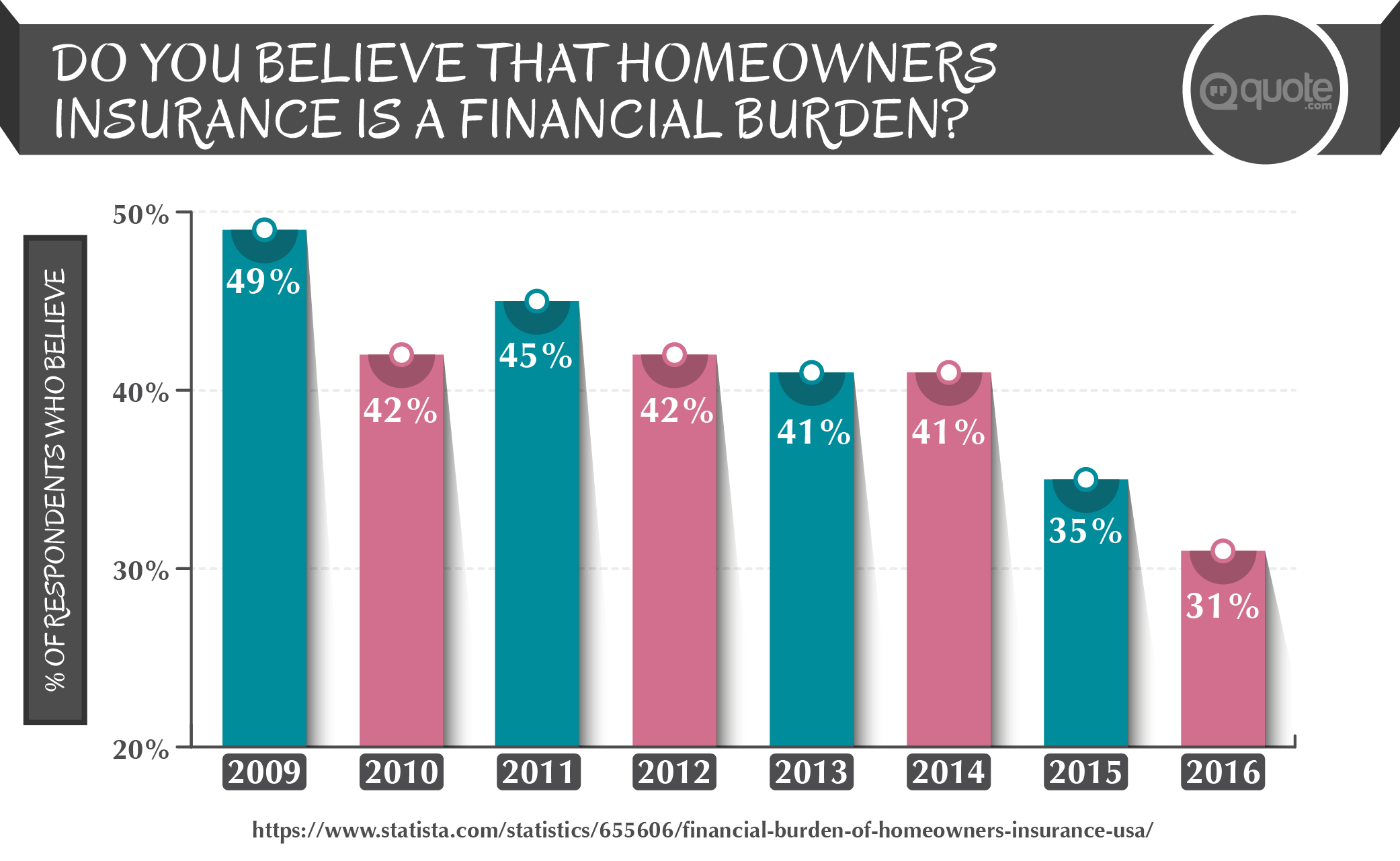

Comparing homeowners insurance rates is the quickest path to cheaper rates. Choosing a higher deductible, making sure you get all the discounts that you can and not filing too many claims can also ensure you get the cheapest home insurance. The average home insurance ratenationwide is $2,777 a year, according to 2022 Insurance.com data. Of the many things that affect the cost of home insurance, where you live is one of the biggest. Home insurance costs in each state are affected by things like extreme weather and the cost of building materials. If you change your coverage, like adding an endorsement or increasing a coverage limit, your premium will likely change.

We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Average homeowners insurance cost by state

Oklahoma has the highest home insurance rates in the country at $5,317 a year. Hawaii, on the other end of the spectrum, is the cheapest state for home insurance at only $582 a year. Hurricane risk is causing home insurance struggles for Louisiana homeowners and insurance carriers operating in the state. In coastal states like Florida and Louisiana, some initial estimates have put the full cost of Hurricane Ian’s damage at $41 to $70 billion. Florida’s home insurance market is struggling due to widespread roofing scams and fraudulent lawsuits. These issues place a financial strain on insurance companies, which is causing many companies to pause business, pull out of the market or go insolvent.

We offer insurance by phone, online and through independent agents. You can also consider raising your deductible and looking for discounts. One part of a state might have higher rates because there is more crime.

If you ever feel the need to know what commission we'd earn on any of our insurance products, just ask us. If you live in a place that has frequent or recurring natural disasters, insuring your home against them is wise. You should cover things like engagement rings, investment metals, and art collections with their own policy. When deciding whether you need any additional coverage, consider the value of your home and assets, as mentioned above. If you are renting your townhome, renters insurance is the best option. Your townhome insurance amount will depend on the type of townhome it is.

Homeowners insurance costs are rising, likely due to inflation, supply chain disruptions and increased costs for materials and labor. Finding the right homeowners insurance policy doesn’t have to be complicated. We recommend you take an inventory of your belongings and estimate their replacement value before building your policy. That way, you’ll know if that 50 percent determination is appropriate. If you want peace of mind, consider adding one of these policies to your home insurance coverage.

You need enough coverage to account for all your assets in case you're sued because of injuries or damages at your home. For homeowners insurance with $300,000 in dwelling coverage, Oklahoma has the highest rate at $5,317 and Hawaii has the lowest rate at $582 based on a 2022 analysis by Insurance.com. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

It’s vital you keep this in mind, as not all homeowners insurance in Prague, Nebraska provide coverage for all of them. Property owners who pay off their home loans faster will see less high priced insurance policy sooner. Try out to improve the amount you pay each month to pay out it off quicker.

No comments:

Post a Comment